26+ Pay Calculator Massachusetts

Calculating your Massachusetts state income tax is similar to the steps we listed on our Federal paycheck calculator. That means that your net pay will be 43085 per year or 3590 per month.

105 Piedmont Avenue South Charlottesville Va 22903 Compass

Salary Paycheck Calculator Massachusetts Paycheck Calculator Use ADPs Massachusetts Paycheck Calculator to estimate net or take home pay for either hourly or salaried.

. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Massachusetts. Paid Family and Medical Leave employer contribution rates and calculator Most Massachusetts employers must make payroll withholdings on behalf of their workforce to comply with the Paid. If you make 55000 a year living in the region of Massachusetts USA you will be taxed 11915.

Massachusetts Salary Paycheck Calculator Change state Calculate your Massachusetts net pay or take home pay by entering your per-period or annual salary along with the pertinent. The PFML law covers most Massachusetts employees who have earned at least 5700 in 2022 or 6000 in 2023 over the past 4 calendar quarters. Your average tax rate is 1198 and your.

Simply enter their federal and state W-4. Massachusetts Income Tax Calculator 2021 If you make 70000 a year living in the region of Massachusetts USA you will be taxed 11667. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Massachusetts.

Figure out your filing status work out your adjusted gross. In Massachusetts failing to calculate and pay employee wages properly exposes employers to mandatory treble. Well do the math for youall you need to do.

Once done the result will be your estimated take-home pay. Note that you can claim a tax credit of up to 54 for paying your Massachusetts state. For example if an employee receives 500 in.

Massachusetts Massachusetts Gross-Up Calculator Use this Massachusetts gross pay calculator to gross up wages based on net pay. The Massachusetts Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023 and. Simply follow the pre-filled calculator for Massachusetts and identify your withholdings allowances and filing status.

In addition you must have earned. The tax rate is 6 of the first 7000 of taxable income an employee earns annually. Virtual Washington DC February 26-28 2023.

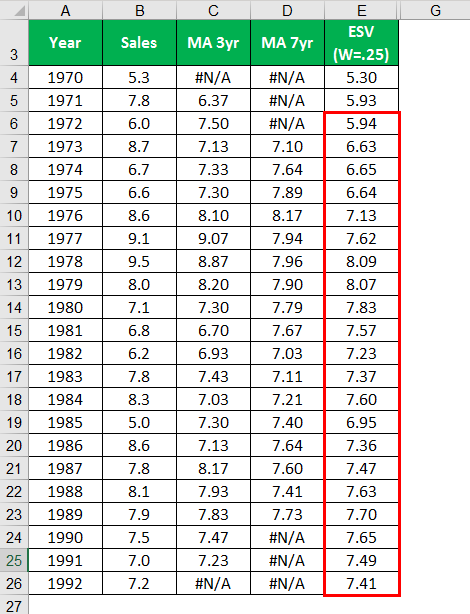

Exponential Moving Average Formula Example And Excel Template

Dean College Profile Rankings And Data Us News Best Colleges

Peroxide Promoted Disassembly Reassembly Of Zr Polyoxocations Journal Of The American Chemical Society

A Robust And Efficient Algorithm For Vapor Liquid Equilibrium Liquid Liquid Equilibrium Vle Lle Phase Boundary Tracking Sciencedirect

259 Ettrick Street Brockton Ma 02301 Compass

1220 Cowford Rd Halifax Va 24558 Realtor Com

New Tax Law Take Home Pay Calculator For 75 000 Salary

Esmart Paycheck Calculator Free Payroll Tax Calculator 2023

Massachusetts Paycheck Calculator Tax Year 2022

760 West St Wrentham Ma 02093 Zillow

7 Powderkeg Way Saugus Ma 01906 Compass

Paycheck Calculator Take Home Pay Calculator

2023 Salary Paycheck Calculator 2023 Hourly Wage To Yearly Salary Conversion Calculator

Ijms Free Full Text Geometrical Properties Of The Nucleus And Chromosome Intermingling Are Possible Major Parameters Of Chromosome Aberration Formation

244 Washington Place Apartments 244 Washington Street North Easton Ma Rentcafe

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Alien Milling Become A Distributor Alien Milling Technologies